Tennessee tax collections $555M short of original budgeted estimates

Published 2:32 pm Monday, July 29, 2024

|

Getting your Trinity Audio player ready...

|

By Jon Styff

The Center Square

Tennessee is now $555.2 million behind its initial budgeted tax collections through the first 11 months of the fiscal year.

Trending

But revised estimates will likely allow the state to remain above the revised estimated – lowered by $798.4 million – approved by the Tennessee Legislature on April 18.

The totals come as the state collected $2.3 billion in taxes and fees in June, $31.5 million below the original budgeted estimate but $34.8 million more than June 2023.

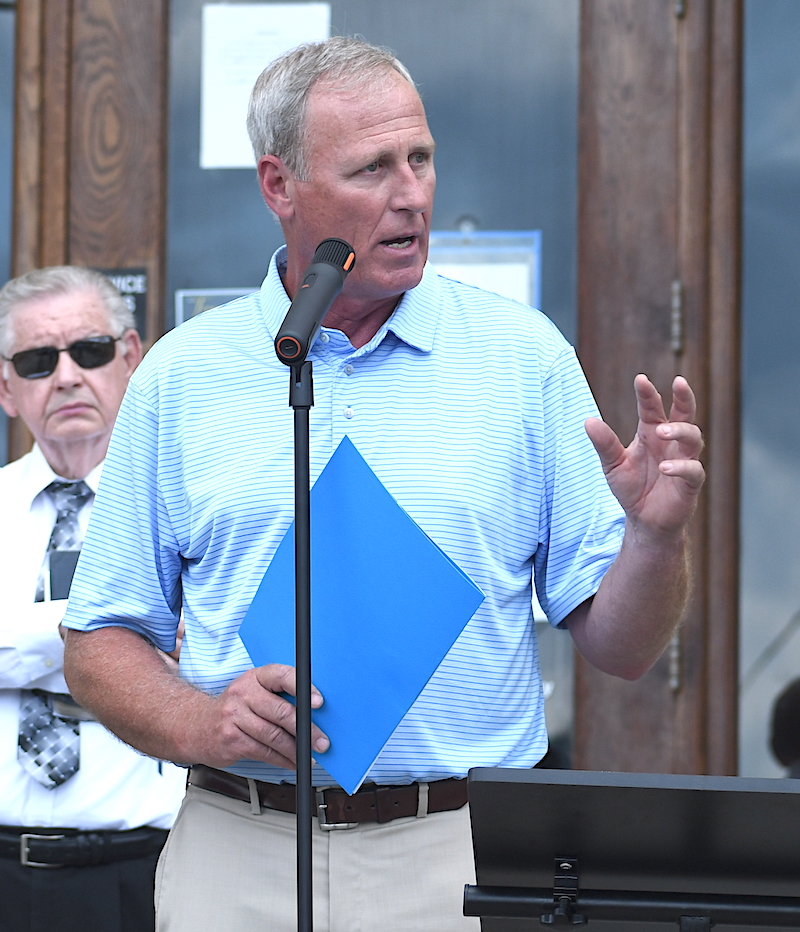

“With one month remaining in this fiscal year, the state seems to be on track to meet the revised 2023-2024 growth rates adopted by the State Funding Board and enacted by the General Assembly,” Tennessee Department of Finance and Administration Commissioner Jim Bryson said. “We are optimistic that we will achieve the revised estimate for the year.”

The largest collection comes from sales tax, which was 2.2% above June 2023 but $14.8 million behind the budgeted estimate.

Sales tax collections are $138.9 million behind budgeted estimates for the year but $213.9 million better than a year before.

Franchise and excise tax collections are $327.7 million behind the budgeted estimates for the fiscal year and down $277.5 million behind last fiscal year.

Trending

“Total revenues in June showed positive gains compared to last year,” Bryson said. “Sales tax receipts, reflecting May consumer activity, grew moderately. Similarly, corporate tax revenues (franchise and excise taxes) held steady compared to June 2023. All other taxes increased by 2.55% compared to this time last year.”